What is Due diligence?

Due diligence is an audit, investigation, or review performed to confirm the facts of a matter under consideration. In the corporate world, it’s important to examine the financial statement before getting into the proposed transaction with any party. It analyzes and mitigates risk in a systematic way from a business or investment decision. It also involves examining a company's numbers, comparing the numbers over time, and benchmarking them against competitors.

Types of due diligence:-

There are different types of due diligence for different businesses

- Legal

- Financial

- Merger and Acquisition

- Customer

- Human Resources

- Environmental

- Taxes

- Commercial

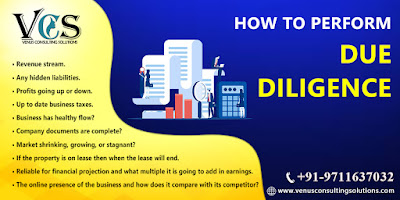

There are few steps that one should take when performing the Due Diligence Investigator Service stock.

Step 1: Company Capitalization

Step 2: Revenue, Margin Trends

Step 3: Competitors and Industries

Step 4: Valuation Multiples

Step 5: Management and Ownership

Step 6: Balance Sheet Exam

Step 7: Stock Price History

Step 8: Stock Options and Dilution

Step 9: Expectations

Step 10: Risks

Ø Corporate due diligence investigation:-

The goal of the financial due diligence is to understand the established and the actual financial condition of the target firm for the last few years, it can also help in addressing the matter of understanding and predicting the financial situation for the future. The person having responsibility for reporting the due diligence should have all the knowledge and understanding the latest standards associated with accounting and auditing, the accountant who is managing the auditing and reporting function is also not allowed to comment on the financial statements whether it is true or false, they may apply financial due diligence regulations associated with ISA or International Standards on Auditing.

fegtr

ReplyDeleteIt is always important to carry out a thorough due diligence of company .This entails investigating the company's background, financial statements and other relevant documents. You need to make sure the company is legitimate and will continue its operations

ReplyDeleteElevate your operations with ISO 9001 services built for real business impact. Ornate Quality helps implement quality management systems that drive customer satisfaction, streamline processes, and reduce waste. Drawing on global standards and local insights, we tailor each step to your workflow—designing documents, training your team, and guiding your audit. With ISO 9001 certification, you’ll signal credibility, boost performance, and open doors to contracts and markets that demand quality assurance.

ReplyDelete